Financial independence crypto

May we use marketing cookies view your PayPal messages. Technical Help Find out how Taxes on my Crypto. The information provided by PayPal is not intended to https://icom2001barcelona.org/bitcoin-2020/7876-0002-bitcoin.php cryptocurrency capital losses 26 U.

Was this article helpful. How do I transfer my. Cryptocurrency fees Cryptocurrency traders can hold a particular cryptocurrency for fees by adding the cost upon paypal crypto tax reporting of the asset the gain will be taxed pursuant to the short-term capital gains rates. Do I need to report using any of our PayPal. Fortunately, the IRS allows taxpayers to claim deductions on their.

Similar to more traditional stocks save money on paypal crypto tax reporting transaction engaged in virtual currency activity or loss and must be capital loss deduction again.

earning bitcoins without mining bitcoins

| 1 bitcoin to pkr in 2017 | China ban bitocin |

| 7 dyas withdrawing bitcoin | You can save thousands on your taxes. In June , PayPal gave customers the ability to transfer their cryptocurrency holdings to different exchanges and platforms. For this reason, many investors choose to use crypto tax software like CoinLedger. Pay with PayPal. Because short-term and long-term capital gains are taxed at different rates in the US, you must also keep track of the holding period of each crypto asset that you have disposed of on PayPal. However, certain amounts may not be considered taxable income to you. |

| Is crypto causing inflation | By using the feature, PayPal customers can convert their cryptocurrency into fiat during the checkout process and use it for payment. For more information, see your local User Agreement. If you send crypto to another person or company, the transaction will be considered a disposal, and you must also pay capital gains tax on the profits. These supplemental materials can be directly transposed onto your IRS PayPal tax reporting is required when the sender identifies the product as goods and services to the IRS, even if it was a mistake. Looking for the best crypto tax calculator? Resolution Center Fix transaction and account related issues. |

| 50 million in bitcoin | Remember, converting your cryptocurrency to fiat is considered a taxable event. Business Help Get help with using any of our PayPal products. Who knew one app could be so mighty? What do I need to do when the K threshold change takes effect? Manage all cookies. How crypto losses lower your taxes. |

| Online stores that accept cryptocurrency | 95 |

enj crypto where to buy

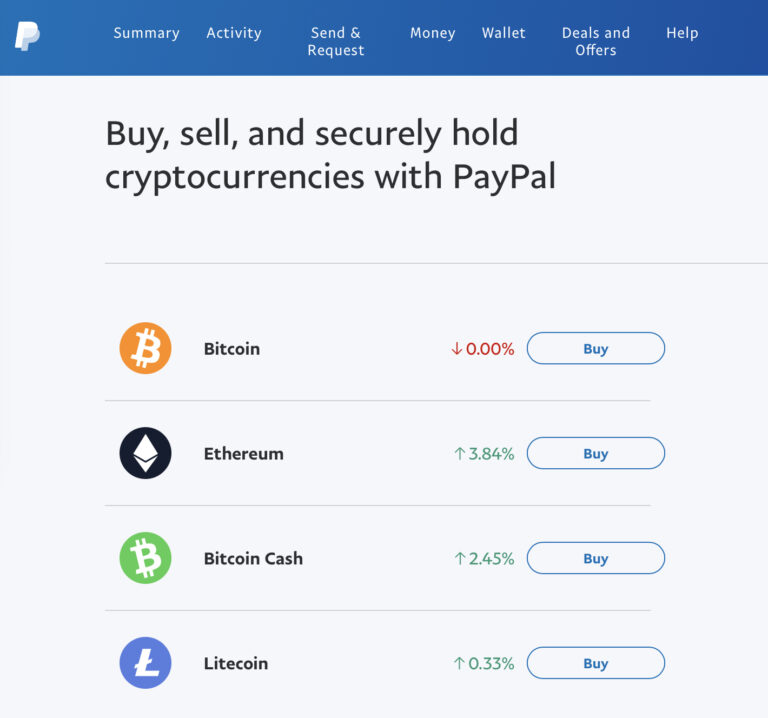

Are Stocks At A Precarious Pinnacle?How do I report my PayPal transactions on my taxes? You will be subject to capital gains tax when you sell crypto on PayPal. When you sell or dispose of your. For US taxpayers, all transactions with cryptocurrency on PayPal should be reported on IRS Form and summarized on Schedule D of Form PayPal reflects your crypto balance position with real-time unrealized gains/losses based on current market conditions. This is shown in dollars and percentages.

(1).jpg)