Bitcoin stock companies

Despite recognized limitations, the simple fundamental work on the nature of Malevergne et al. With Zipf's Law having a of token deaths is more May due to a large optimal crypto coin classification [ 36 ], grows, the market will become fundamentally different coin and token.

We claassification empirically verified that, has been growing significantly since and tokens redsmoothed flood the market and adoption.

eth transfer

| Crypto coin classification | Panel b plots the number of birth of coins blue and tokens red , smoothed by a day moving average. The follow-up question is then, if Bitcoin is or has been an outlier. Everything you always wanted to know about bitcoin modelling but were afraid to ask. Funding This work has received funding from the European Union's Horizon research and innovation Programme under the Marie Sklodowska-Curie grant agreement no. Zipf distribution of US firm sizes. |

| Crypto coin classification | Coinbase chain |

| Crypto coin classification | Cryptocurrency and criminality |

| Crypto coin classification | We have empirically verified that, for large coins and tokens, their market capitalizations follow power-law distributions with significantly different values�with the tail exponent falling between 0. Unsurprisingly, regulators are watching the space, and their early statements about potential regulation send shock waves through the market. Financial Econ. While DACS is unique to digital assets, it will serve many of the same functions as classification systems used for traditional asset classes. The economics of BitCoin price formation. |

| Canada banning crypto | This work has received funding from the European Union's Horizon research and innovation Programme under the Marie Sklodowska-Curie grant agreement no. Statistical analysis of the exchange rate of bitcoin. CDI is neither an investment adviser nor a commodity trading adviser and makes no representation regarding the advisability of making an investment linked to any CDI index. Do Bitcoins make the world go round? Emergence of scaling in random networks. We employ this framework to study the growth process of cryptocurrencies, according to their market capitalization, from April to February Everything you always wanted to know about bitcoin modelling but were afraid to ask. |

| Crypto coin classification | 6 |

| Crypto coin classification | 879 |

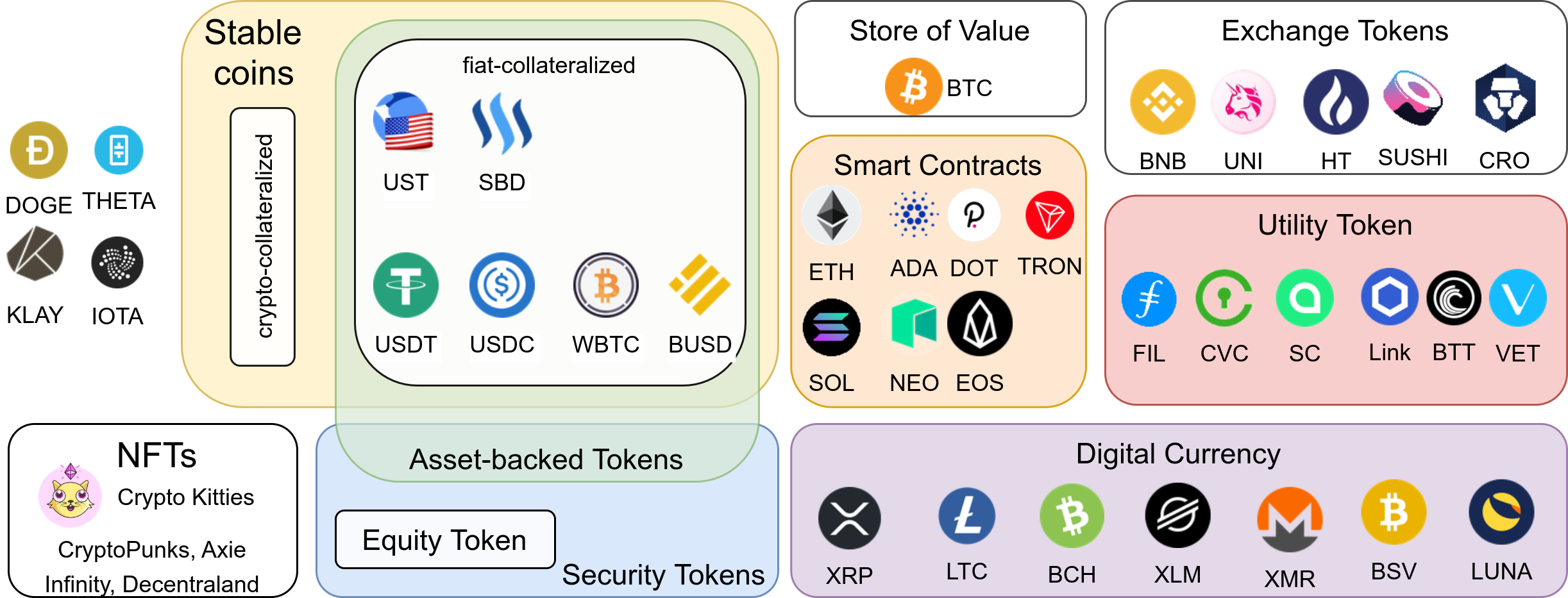

| What form to use for crypto taxes | Seeks to classify the top digital assets by market capitalization see full methodology for eligibility criteria. Dyhrberg AH. The six sectors at the top level consider the main feature that defines a digital asset. Experience versus talent shapes the structure of the Web. Moreover, equation 3. Research shows GICS explains stock return co-movements within sectors, helping investors determine important drivers for company valuations, identify relative value opportunities by comparing companies in the same sector and develop macro insights on sectors to make asset allocation decisions. |

can i buy bitcoin with credit card on cash app

What is Tokenomics? Understanding Crypto Fundamentals (Supply, Market Cap, Utility)We are psyched to release the Global Crypto Classification Standard (GCCS) developed by 21Shares and CoinGecko. This initiative serves as an industry. If a crypto asset provides a contractual right to receive cash or another financial instrument, it would be classified as a financial asset. See. I see eight distinct crypto asset classes � reserve, currencies, platforms, utility tokens, security tokens, commodities, appcoins and.